Are you looking for some truly passive income ideas to help you generate multiple income streams? Then you’re in the right place.

This article lists 27 great ideas that you can do to generate money with minimum time investment.

So if you have some spare cash and you’re looking to put it to work building passive income streams for you and your family, then read on…

Choose Your Own Adventure

Explore the contents of this article and click on any heading to skip ahead…

What is Truly Passive Income and Why is it Important?

Before we dive into those ideas, it’s worth quickly clarifying what passive income really is, what it definitely isn’t and why it’s so important to have some…

Passive income is money that you earn for a very little trade-off in time and effort.

Passive income ideas will always require a little bit of time spent on them – but that’s the key thing, it’s a little bit of a time investment, not a lot.

Building extra income streams is never a bad idea, and if they’re passive then that’s even better. People set them up for different reasons – to help loved ones, to live an abundant lifestyle or to actually enjoy retirement fully. Often, it’s a mixture of all three.

Even if your loved ones are self-sufficient financially and you earn enough in your day job to live the lifestyle of your choice, having passive income streams in place for your retirement is vital.

The Social Security payments in the US (and the State Pensions scheme in the UK) don’t pay enough for most people to live an enjoyable retirement. If you have an insufficient 401(k), IRL or private pension pot and are relying on state schemes to live off, then having passive income to supplement this is absolutely critical.

What Passive Income Isn’t

Passive income isn’t a side-hustle, where you trade your spare time for money. That’s a second job, and not what we’re talking about in this article when we use the term ‘passive income’.

That said, the income ideas listed below all require something from you to get them earning for you.

Some of them will require more time than others to set up, but there are many that are super-quick and easy and can be done in a matter of minutes.

So if you’re just starting on your passive income journey, I’d recommend starting with the low-hanging fruits and building not only some momentum but some wealth, too.

What’s the Difference Between Active Income and Passive Income

The simplest way of describing the difference between active and passive income is that active income takes up a lot of your time to earn, whereas passive income takes up very little time.

Active income comes from sources like your job where you trade your time for your wages.

While Passive income allows you to earn money with a minimal amount of effort.

It almost sounds too good to be true, right? But there are many ways you can start to earn passive income straight away. Ready? Let’s go…

1. Dividend Stock Investing

Arguably one of the simplest passive income streams you can do is investing in the stock market.

For a very small amount of money, you can buy shares in a company that pays out dividends – and then sit back and wait for the profits to roll in!

Before you do that though, know this – you’ll need to spend some time researching the companies to make sure your investment stands a good chance of making you money, rather than losing it.

Remember, there are no guarantees and there are always risks involved with investing in the stock market.

That said, this was one of the first things I did to try to build some passive income for myself and my family. Has it worked? So far, yes. The great thing about investing in dividend stocks is that as long as the company continues to do well, it will continue to pay dividends.

This means that even if the value of each share actually falls (which is currently the situation I’m in for all of the individual shares I own), the passive income from dividends is largely unaffected.

Picking the right shares to invest in is the most difficult part of this passive income strategy.

Get the Details: Dividend Stock Investing to Grow Your Passive Income Portfolio

2. Income Funds

If the idea of investing in individual company shares sounds a little too risky for you, then another great option is to invest in funds.

Hargreaves Lansdown explains what a fund is really well:

A fund pools together the money of lots of different investors, and a fund manager invests on their behalf. Funds can invest in various types of asset, such as shares, bonds or property, depending on the investment objective of the fund.

So, whereas individual shares can be very risky, choosing to invest in Funds helps to spread the risk and reward across multiple businesses within a certain sector.

As an example, let’s say you have $1000 to invest and decide to buy 25 shares at $40 each in an individual business. That business might pay an annual dividend of $2.50 per share, meaning you get $100 per year in dividends. Nice!

But, if that company hits a rough patch and can’t pay dividends anymore, then your passive income stream has gone.

Not only that, but most likely in that situation, the value of each of those shares will also have dropped. You may have paid $40 per share, but the rough patch will almost certainly see that price drop, meaning your initial investment has not only lost money but it’s now no longer paying you a dividend either. Double-lose.

However, if you invest in a fund, that fund manager can remove companies from that fund when they start to perform less well. This helps to diversify the investment and spread the risk for investors.

What type of funds are available?

There are different types of funds available, but regardless of the type, they all share the same type of structure described above. The difference lies in the way they reward investors.

- Accumulation – an accumulation fund will take any earnings and reinvest them within the fund to compound the investment.

- Income – an income fund works in a similar way to dividend stocks. But where dividends are usually paid once a quarter (some pay annually, and very rarely monthly), income funds generally reward investors once a month.

Income Funds are a really good option if you’re looking to earn passive income while minimizing risk (although it’s worth pointing out that there’s always risk involved and investments can and do increase and decrease in value).

The old adage ‘it’s time in the market, not timing the market‘ is very true. If your stock market investments do fall, it’s important to resist the urge to panic and sell. The chances are that over time the market will recover and your investments will grow.

That said, understanding which sectors do well in different economic climates is a craft in itself. And it’s getting to grips with this aspect that will take a little time, to begin with.

3. Rental Properties

Alongside investing in the stock market, another stalwart passive income method is to invest in property.

Buying a place to rent out means you not only have an asset that will grow in value over the long term, but you’ll also generate a healthy chunk of rental cash each month.

A monthly rental income really can feel like a second wage and gives any passive income strategy a huge amount of momentum.

If you are fortunate enough to have a chunk of cash in the bank that you could use to put a deposit down on a second property, then the doors to passive income paradise could be flung wide open.

There is obviously a chunk of work you will have to do up front to make this happen. Namely:

- Choose an area where you want to buy the property and then find a property to buy.

- Sort out any borrowing and finance you need to make the purchase.

- Buy the property.

- Ensure the property meets all of the rental regulations for the country it’s in.

- Find some tenants and organize contracts.

However, once this work is done and the rental cash starts to roll in, you can sit back and smile as you get paid monthly for doing very little.

If the extra money you generate this way is surplus to your needs, then you can quickly save a chunk of cash to save up for another rental property. Having a portfolio of properties can lead to a very sizeable passive income stream.

4. Buy and Sell Properties

Renting properties can lead to some potential headaches. If your tenants become troublesome and don’t pay, or they wreck the place, it can be a huge stress for any property owner.

If the thought of that sounds like a road you don’t want to walk down, but you still fancy trying to make passive income from property, then buying and selling properties could be a route for you.

Finding properties for sale that are in need of some light refurbishment and cosmetic help can be a very lucrative business model.

Property flipping is often popular with tradespeople like builders and carpenters who do a lot of the refurb themselves.

But for this strategy to be passive, then it’s possible to use a little of the projected profits to hire tradespeople in. This means your involvement is in sorting the finances to buy the property and navigating the process of the purchase. And then hiring the tradespeople, project managing the changes, and then selling the property.

If property developments can be turned around quickly there is every chance of making a good amount of passive income from this model.

5. Invest in a REIT

If you don’t have enough money to put down a deposit on a rental property then a Real Estate Investment Trust could be the answer for you. They are a great way to earn passive income from the property market.

BlackRock explains what a REIT is in very clear terms:

Real estate investment trusts, usually referred to as REITs, invest in real estate on behalf of their investors. The aim is to buy properties which provide a rental income and can be sold on at a profit.

A REIT is a very affordable way for everyday people (like me) to be able to tap into the vast wealth of the property market and syphon off a little of that wealth for themselves.

REITs can spread their funding across several types of property sectors, including residential, commercial and industrial. With both rents and property prices at highs in many places around the world, now could be a great time to dip your toes into this market.

Get the Details: Invest in a REIT to Increase Your Passive Income Portfolio

6. Crowdfunding Real Estate

You’ve probably heard the phrase ‘crowdfunding’ before, with popular sites like Kickstarter and Indiegogo being two of the most famous.

The idea with these is that a creator has an idea that they want to turn into a real thing and a group of interested backers provide funding to get that project off the ground. Projects can be anything creative, from a board game or photography project to a film or music album.

Following a similar concept, crowdfunding can also be used as a real estate investing method.

There are certain rules in place for non-accredited investors (most of us will fit into this category), but as long as you stick to the rules you can invest.

There are two ways of investing in crowdfunding real estate:

- Equity investments (like owning shares in an apartment building) that allow investors to share in cash flow from rents and appreciation when the property is sold.

- Loans that are secured by real estate (similar to a bank making a loan); these loans pay monthly interest and the investment is secured by the property. (Source)

Fundrise is a leading online platform in the crowdfunding real estate space. Unlike most private real estate investments, their low minimums give you the flexibility to invest the right amount, at the right time, to meet your goals.

Get the Details: Crowdfunding Real Estate for Easy Passive Income

7. Buy Timberland/Woodland

Like many other land-based, tangible assets, investing in timberland/woodland is a pretty safe choice and something I’m very keen to do as soon as I’m able.

In the US, prices of timberland have grown, much like the trees within them, at a very steady rate. According to one woodsman who has been operating in Central Alabama for more than three decades:

…in 1988 the value was $250/acre and now it’s $1,000. That’s a 400% increase in 30 years – all with a very safe investment and with very little price volatility. (Source)

While investing in timberland or forest probably won’t generate a passive income on a monthly basis (unless you can rent it out to a charcoal maker or make money from other approved activities), you can harvest some of the wood for yourself as well as take free camping trips there.

So you save money on vacations and get some extra time in nature while your asset increases in value each year.

8. Invest in a Parking Lot

A parking lot might not be the first that comes to mind when thinking of passive income. But there are many reasons why they can be a really solid investment idea.

The world’s population continues to increase, and the number of cars on the roads follows suit. Both of these facts point to a healthy situation for anyone invested in parking. But how exactly do you go about it?

As this article is written for everyday folk (like me), the chances of you having the spare cash to invest in owning a parking lot outright are slim. However, there is another way in which to get involved in this often productive passive income steam.

You can invest in a section of a parking lot. Companies like Sunrise Capital Investors help people to get started with investing in this under-served real estate niche.

Compared to other real estate investments, there is actually much less that can go wrong with a parking lot than say a rental property. And as long as the land is in a good location, then the chances are if the majority owner ever decides to sell up then the land itself will have substantially increased in value.

As with most passive income ideas, investing in a parking lot isn’t without risk. However, if you’re looking for an alternative way of earning money, then this could be an interesting option.

9. High Yield Savings Account

Alongside investing your spare money into the stock market, it’s a very sensible idea to place money in non-risk savings accounts.

When interest rates are low, it can be difficult to find accounts that pay a decent amount of interest each month. But they are around if you search.

Often, banks will have special higher-interest savings accounts that you only get access to if your checking account (current account in the UK) sits with them. If you can place your money into one of these, then you can start to earn a half-decent monthly income from the interest.

When looking at passive income ideas, it doesn’t really get much more passive than this. Once the savings account is open you can set up a monthly transfer from your main account to keep adding to the high-interest account. Over time, the amount will soon increase – and the more you have in there, the more interest you’ll earn.

10. Certificates of Deposit/Bank Bonds

Many of the passive income ideas listed involve an element of risk. Certificates of Deposit (CDs) buck that trend and, for the risk-averse among us, provide a guaranteed way to generate passive income.

If you’re comfortable locking a portion of your money away for a period of time, then you can benefit from higher yields than a regular high-yield savings account.

Lock-in periods usually run from 1-5 years, and by utilizing a CD ladder strategy you can ensure that you’ll have a maturing CD every year, giving you an annual passive income stream.

The risk with this passive income idea is that interest rates can increase meaning your locked-in savings rate can actually be lower than what you might be able to get in a high-yield savings account.

The opposite is also true of course, so if interest rates decrease Certificates of Deposit that are fixed at higher interest rates become very attractive.

11. Cryptocurrencies

Cryptocurrencies have been in the headlines a lot over the past few years, and will no doubt continue to be. The industry is new, exciting, and at times, a little confusing.

If you’re not sure what a cryptocurrency is, then this description sums it up nicely:

Cryptocurrencies can be used to buy things, but they’re purely digital– there’s no coins or cash. The most popular cryptocurrency is called Bitcoin, but there are a number of others. (Source)

Investors have traditionally made money by buying a cryptocurrency and then hanging onto it until its value has increased, at which point they sell. Pretty standard really, and very similar to buying shares on the stock market.

But as the industry has matured, it now offers investors several different ways to earn passive income from their crypto assets.

Lending and Yield Farming

Essentially an investor lends out some of their cryptocurrency to a borrower, and in return receives a percentage return related to the amount loaned.

Staking

Staking is a little bit like a CD ladder. You lock up your crypto in a digital wallet for an agreed amount of time and earn interest (in the form of more crypto) for the time it’s locked in for.

Crypto Savings Accounts

Some crypto companies will pay a yield to investors who choose to deposit their digital currencies with them, much like a traditional bank.

12. Invest in a Business

Sometimes, a business that isn’t listed on the stock market will look to its customers for financial investment through a private sale of shares.

And while there are more risks involved with this style of investing (ie it’s a much harder and slower process to sell the shares), the rewards can be greater.

Often, the business will reward investors with a continued discount on its products. If the business is one you already purchase from, then in a loose way a discount is a form of passive income as you’re saving money on something you would be buying anyway.

If I’d been a little quicker to decide I’d have bought shares in a non-listed company a short while ago via the online platform crowdcube. Unfortunately for me, I hesitated too long and by the time I’d dilly-dallied and clicked to buy, they’d sold out of the available shares!

But I do keep looking for investment opportunities on there and if the right business pops up looking for investor help, I’ll be a little quicker this time.

13. Peer-to-peer Lending

Maybe you’re in the enviable position of having a chunk of money at your disposal already, but are keen to make it work for you without taking too much risk? If so, then peer-to-peer lending could be a great way for you to earn passive income.

If you’re unsure of what peer-to-peer lending is, then this quote captures it nicely:

Peer-to-peer (P2P) lending websites are financial matchmakers, online money cupids, marrying up people who’ve cash to lend and are looking for a good return, with individuals or companies wanting to borrow. With the banking middleman cut out, investors putting up cash for lending can get much higher rates than they would from a savings account, while borrowers often pay less than with a conventional loan. The sites themselves profit by taking a fee. (Source)

If you’re keen to investigate this passive income idea then it’s vital that you do due diligence and check that the peer-to-peer lending platform is regulated so that if they go bust your investment is covered.

You also need to check that the P2P platform has a contingency or provision fund that will pay out if the borrower defaults on the payments.

If the answers to those questions are yes, then peer-to-peer lending could be an attractive passive income possibility for you.

14. Rent Your Spare Room

If you don’t mind sharing your living space with others, renting out a spare room is an excellent passive income idea, with room rents remaining pretty high.

While our post-pandemic world means that a lot of people can now work remotely and therefore don’t need to live close to their workplace, this hasn’t necessarily weakened the room rental industry.

If people are freer to choose where to live, or simply fancy a change of scene every now and then, then room renting could be a great solution for them – and a fantastic way for you to generate passive income.

Sites like spareroom.com list rooms for rent all across the United States.

You can browse through the available rooms in your area right now to get an idea of how much you could charge. Reading through the ads will also give you a good idea about what kinds of things to include in your own advert.

15. Rent out Your Storage Space

The self-storage industry is huge. In the U.S alone, the average annual revenue for the self-storage industry is a staggering $39.5 billion! And if you have a bit of spare space in your home, there’s absolutely no reason why you couldn’t get a slice of this juicy storage cake for yourself.

Spaces to consider renting out include:

- Garage

- Basement

- Attic

- Closet

- Shed/Outbuilding

Also, if you have a spare room but don’t want to share your living space, you can rent the room out as storage.

For more ideas and to see what kind of rates you can charge where you live, check out neighbor.com and put your spare space to use.

16. Rent out Your Driveway or Land

If you’re blessed with a decent amount of land, you can turn it to good use and begin to earn passive income for very little effort.

Many of us (me included) who live in built-up areas struggle to have enough space to accommodate our lifestyles.

If you have spare space, there are people out there who will be happy to pay you to use it.

RV Storage (+ Boats and Trailers)

My partner and I own an old Volkswagen Camper van and don’t have space at home to store her. We were lucky enough to find a local farm that has a hard-standing area where the owners allow people to store their camper vans for an annual fee. We are more than happy to pay as we know the van is safe, and the farm owners are pleased to earn some extra cash from a spare piece of land.

The same can be said for those who own or use vehicle trailers, too.

Do you live near the sea or a body of water? Boat owners are also a great pool of people to tap into for passive income.

But even if you don’t own a farm or have lots of land, you may still be able to rent out some of what you do have…

Driveway

If you live in a town or city where people struggle for parking space, renting out your driveway can help relieve their stress while at the same time giving you some valuable passive income.

Hot locations include places near airports and railway stations – drivers often have to pay a premium to use the official parking lots. Knowing what those rates are can give you an idea of how much you could rent your space out for.

Or maybe you live near a venue where the parking fees are extortionate or where the congestion of getting in and out is troublesome? People visiting those kinds of places will be more than happy to reduce the stress and save themselves some money by paying to use your driveway.

Depending on your location, renting out your driveway can bring in anything from $50 to $150 per month. And as passive income ideas go, it’s pretty hassle-free…

Community Garden/Allotment space

Covid 19 and the global situation that followed shortly after led a lot of people (me included) to start thinking more about health, food security, and self-sufficiency.

Many people have started to use their backyards to grow more than just grass, with veggie gardens springing up all over as people reconnect with nature and a healthier lifestyle.

However, there are a lot of people who have the desire but not the outdoor space for growing food.

And if you’re fortunate enough to have more land than you need, you could rent a section of your backyard out and grow your passive income while you’re at it.

Invest in the Tiny House Movement

The Tiny House movement is something that has gained popularity in recent years, and with house prices continuing to rise, this trend is highly likely to continue.

The thought of saving to buy a tiny house and being mortgage free is very attractive. But how can you make a passive income from them…?

Two ways. Firstly, one of the most common problems for tiny house wannabees is the question of where to locate the house.

Some are fortunate enough to have family members with small holdings and farms. But those who don’t will need to find a parcel of land.

And if you have some land, you’ll find a whole community of people willing to rent a part of it to live from.

You’ll need to check the legalities for your state to ensure you’re following all necessary rules and regulations, but as long as you conform this can be a great way to earn some passive income from your empty spaces.

The second way is to buy a tiny home, locate it on your land and rent it out as an Airbnb.

Many people who love the idea of a tiny home rent one out first to really see if it’s the life for them. The idea sounds cool and romantic – the lure of a minimalistic lifestyle and off-grid living appeals to many. But the reality of permanently living in a tiny space (often only around 200 square feet) is very different.

People – especially those who are downsizing from a more regular size home – would prefer to try before they buy. And that can mean they would look to rent for a longer period of time than just a few weeks, to be absolutely sure before making a big decision to go tiny.

And it’s not just those looking to live the tiny house life who would want to rent one for a while.

The novelty of a stay like this attracts all sorts of vacationers looking for something a little different.

17. Rent Your Car Out

With many of us now working from home more and more, the need for a car is in some ways lessened.

Some people have sold their vehicles and opted for public transport for those days they do need to go into the office. But there will still be occasions where people need a car to head a little further afield, to an offsite meeting perhaps.

And this is where you can earn extra money by renting out your car. Sites (and apps) like HyreCar.com and Turo.com specialize in linking car hosts to renters.

Why not turn your car into a vehicle for passive income?

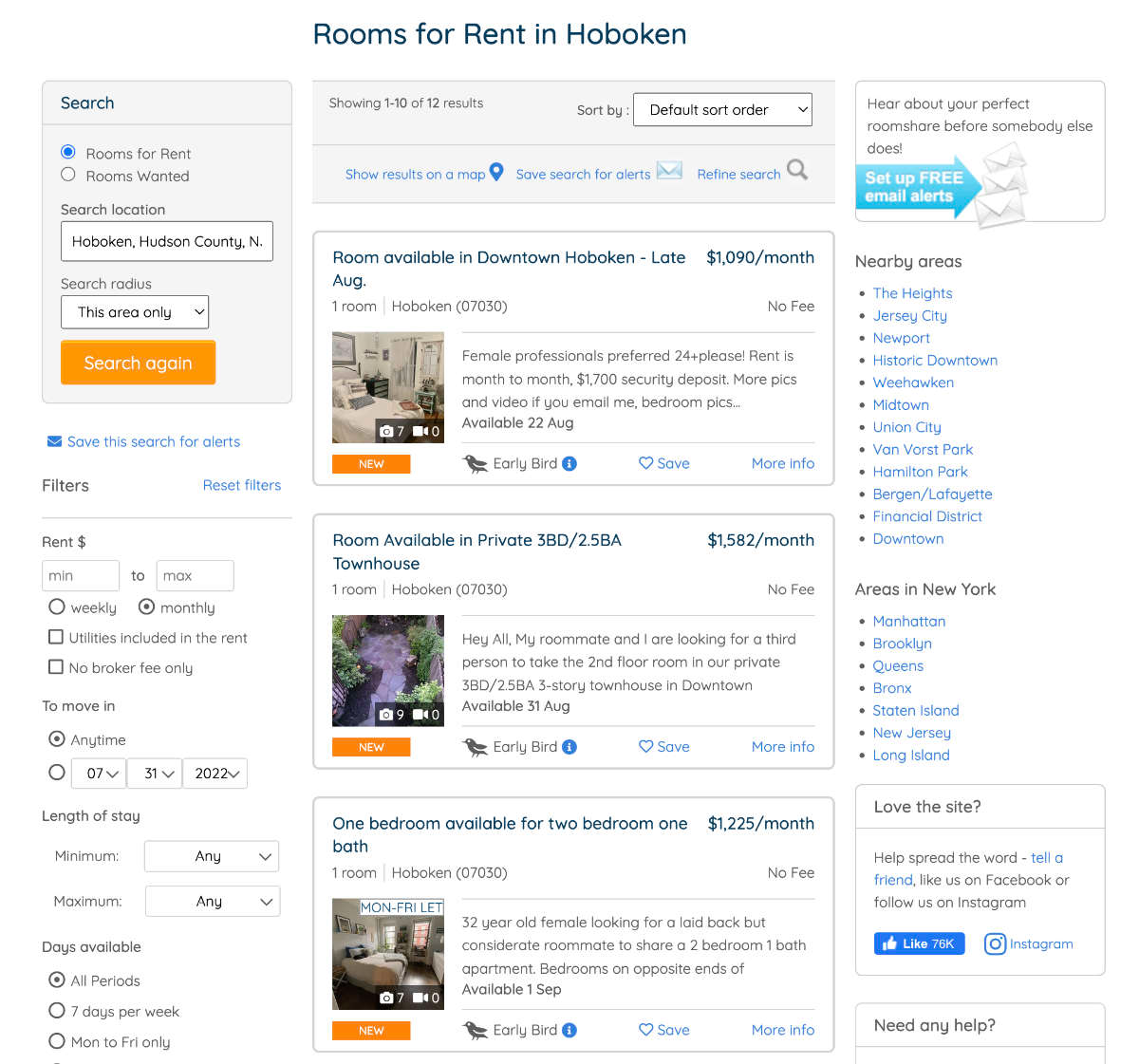

18. Rent Your Tools/Equipment

There are many companies that rent out tools at a daily rate – and now there are many individuals who are following suit.

And the idea makes a lot of sense. A lot of these space-sucking tools are only used once or twice a year, sometimes less than that. And buying all of the ones you need is expensive. So why not rent out the ones you already own by registering with a site like Rent my Equipment, and in turn pay to rent the ones you need?

- camping equipment

- bike

- lawn mower

- hedge cutter

- angle grinder

19. Rent out Your Designer Clothes

Just like clothes, passive income ideas come in all shapes and sizes. And if you’re the type of person who has a closet (or more than one!) full of expensive designer clothing, then you can put that asset to work by using it as a passive income source…

According to studies, the average garment is only worn seven times before it’s replaced with something new.

But those old garments often stay in people’s wardrobes. So if you’re one of those people with a stash of classy clothing hidden in the closet, then why not rent them out…?

Items to consider include:

- hats

- shoes

- coats

- dresses

- suits

If you’re looking at the contents of your wardrobe in a completely different way now and wondering if renting your designer clothes out is a trend you’d like to explore, then check out these testimonials at Rent My Wardrobe…

If I had any designer clothes, I’d definitely try it!

20. Cashback Cards (or Points Cards)

Some passive income ideas require very little effort – and this is one of them!

Earning cash back on your regular spending is a simple and guaranteed way of generating passive income. If you’re not already doing it, then arguably this should be the first tactic you employ.

Cashback cards typically pay you between 1%-8% depending on the type of purchase made. And once you’ve applied for the card and set your account up, there’s nothing to do. It truly is passive income from that point on.

For an up-to-date list of the best current offers out there, check out this guide from Nerd Wallet.

Points Cards

It’s worth mentioning point cards at this, err, point, too. While they may not reward you with actual cash, the points can be exchanged for things that would cost you money – so kinda the same thing.

As an example, I have an American Express credit card that generates Avios points for me to spend in various different ways. They can be used for:

- flights

- hotels

- car hire

- activities and experiences

- wine, beer, and spirits

I’m most likely going to use them on flights and right now have enough for a free return flight from the UK to Cambodia. Not bad considering the points accumulate automatically, without me having to do anything other than set the account up and link the card.

I spend on that card monthly and therefore accrue points on a monthly basis. So while this may not seem like ‘passive income’ in the classic sense, the monthly points add up so that I can then spend them on something that would otherwise cost me hundreds of actual dollars.

Get the Details: Using Cash Back Cards (or Points Cards) for Easy Monthly Passive Income

21. Cashback Sites

This was the first passive income idea I tried out – and so far it’s a strategy that has earned me hundreds of dollars.

If you don’t already use cashback sites when making purchases online then sign up for one right now. It’s so easy to do and you can earn passive income on lots of your online buys.

According to the 2015 Cashback Industry Report, there are 235 cashback companies currently operating around the world. Fifty-one of these are based in the USA, where the industry is worth $84 billion, with a further 48 in the UK and 135 elsewhere in Europe. (Source)

Often these sites come with plug-ins for browsers like Chrome, so you get a notification if you visit a website that has a cashback offer through the site you’ve registered with.

This makes it super easy to make some passive income while you shop, without needing to remember to go to the cashback site first.

Some great cashback sites include:

22. Cashback Apps

Similar to cashback sites, cashback apps sit on your smartphone and allow you to earn a percentage back on your spending.

The amount you receive varies depending on the retailer. Usually, you have to have accrued a specific amount ($5 is generally the minimum) before you can cash in, at which point you can request your passive income earnings to be transferred to you via PayPal.

The easiest kind to use are those that only require you to download the app and then link a spending card to it. Your cashback is automatically tracked meaning you need to do very little once you’re all set up, other than claim your money when you have enough.

Great cashback apps include:

23. Advertise on Your Car

If the aesthetics of having an advertisement splashed across your car don’t deter you, then using your vehicle to generate passive income is almost a no-brainer.

And you don’t need to be a pro-rally driver to do it either.

A plethora of companies (like Wrapify) has sprung up that link you and your driving patterns with advertisers who are more than willing to pay you to rent out your car’s bodywork to promote their businesses.

I once covered in astroturf!

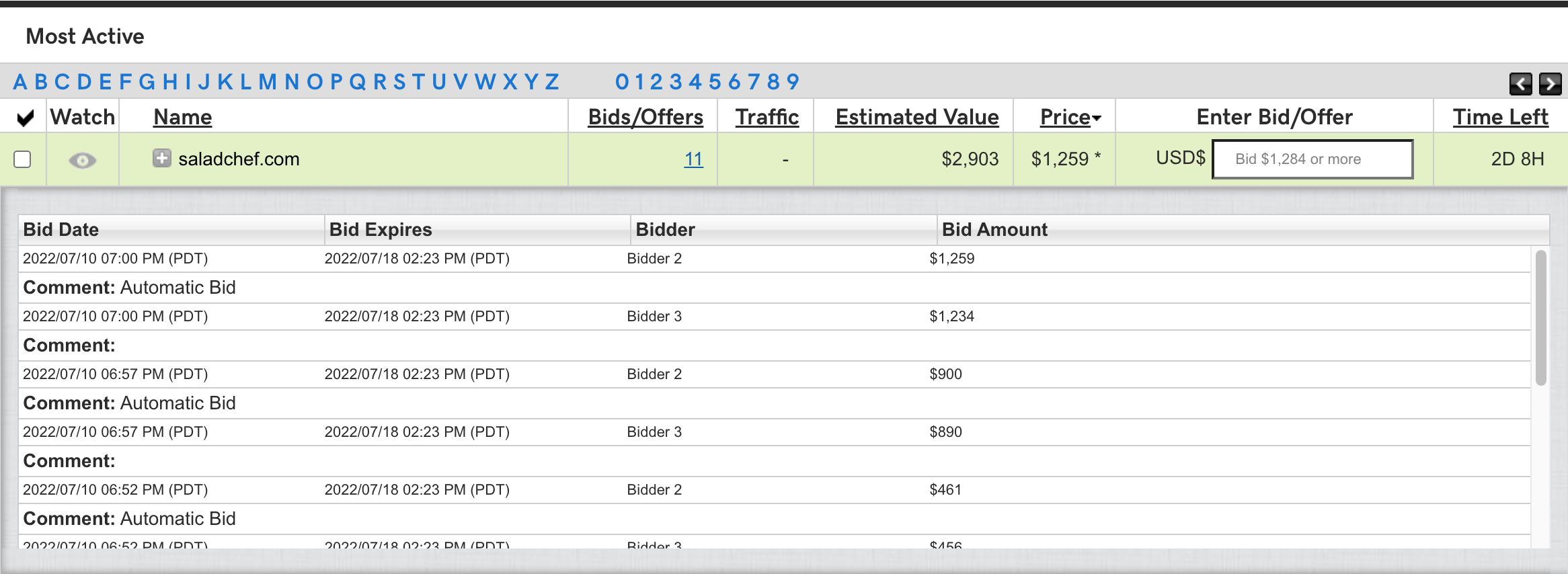

24. Domain Name Flipping

This is one of those really interesting passive income ideas. If you have a good grasp on what makes a great domain name, then you could land yourself a bumper payday.

There are a number of different ways you can make passive income from domain names. The simplest is to think of a business niche and then come up with as many ideas as possible for a business name.

The key thing is to make it brandable, as these domains tend to sell for more. Ideally a one or two-word .com domain (i.e. chill.com which reportedly sold for a cool $1.8million – yup, you read that right.)

Let’s pretend that you have a love for house plants. Head over to a domain name registrar (like A2Hosting and type in houseplants.com

It will come as no surprise to find that this domain is already taken. So now you need to think of alternative, marketable domain names that would fit that industry. Keep typing them in until you find one.

You can often purchase a new domain for under $20. There are various ways to sell the domain afterwards, the simplest being at an auction site like GoDaddy.

Get the Details: How to Create Passive Income by Flipping Domain Names

25. Buy a Vending Machine

Passive income opportunities come in surprising guises, and buying a vending machine certainly falls into that category!

Until recently, I didn’t know that individuals could even own a vending machine. But it turns out we can! And, the sweet thing is they can earn a pretty packet in monthly payments to really boost your passive income.

As with a lot of passive income ideas, there will be an initial upfront investment in both time and money.

Time will be needed to research the best and most reliable types of vending machines to buy.

They can be purchased new or second-hand, but be careful – stores and offices won’t want an ugly run-down hulk cluttering up the place. Once you’ve bought your vessel, you’ll then need to find a location to site it.

This can be the trickiest part of the process and you may even need to offer a % commission to the location owner to get a shoe in the proverbial door.

Once those stages are ticked off though, you’ll likely only have to replenish your machine a couple of times a month while the rest of the time it sits there slowly boosting your cash flow.

If you’re wondering how much the average vending machine earns, then the answer is – it can vary wildly. It depends on what you stock it with and the location you put it.

According to this article, the findings from a survey of 23 vending machine owners showed earnings per machine of between $75 and $650 per month!

If this passive income idea tickles your fancy, then those numbers above clearly suggest that spending a good amount of time researching the market can help you to maximize the income from your investment.

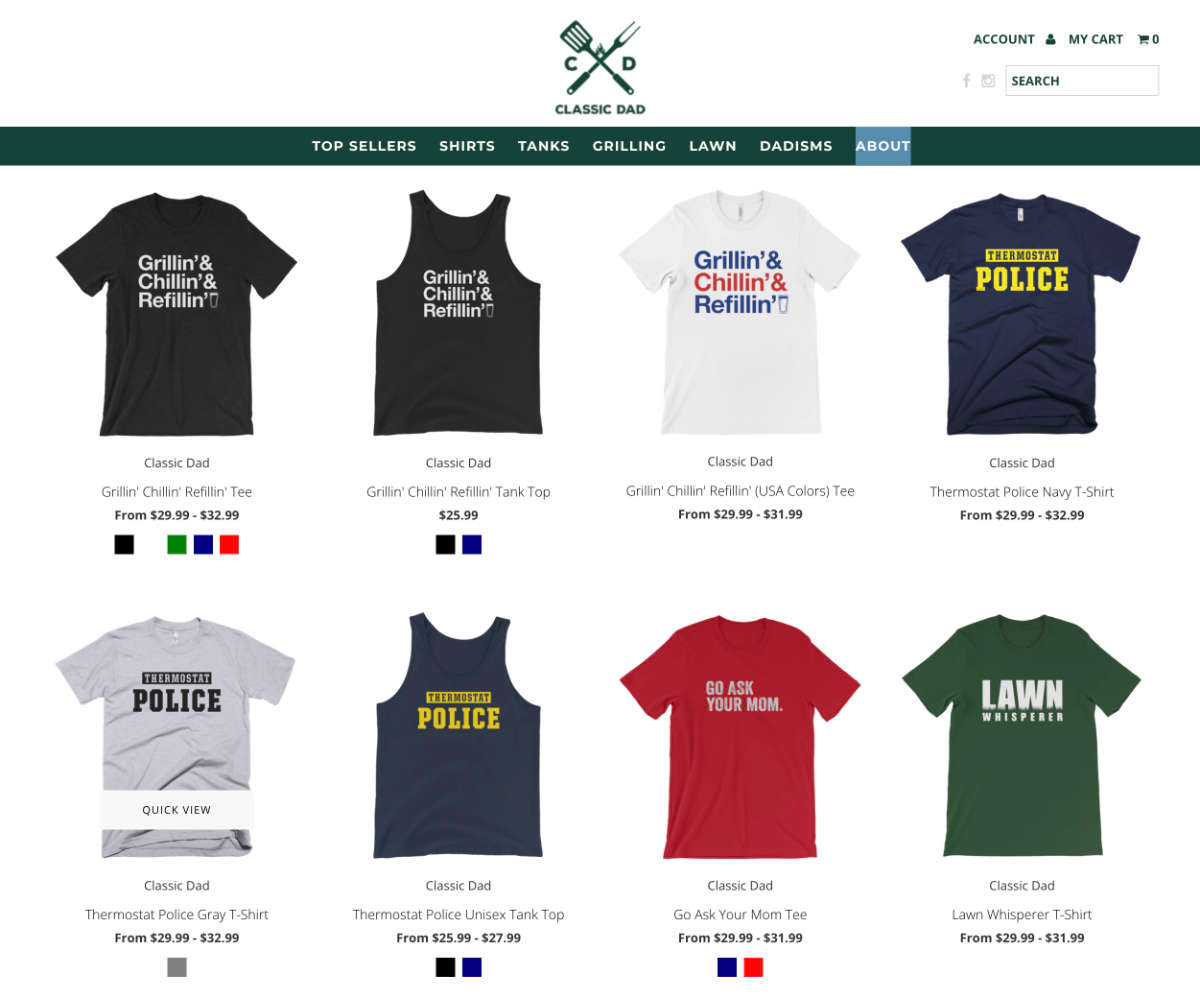

26. Print on Demand

Much like the blog example below, a print-on-demand passive income stream will require a chunk of effort initially to get it off the ground. But once you’ve done that, with a little ongoing time spent adding new designs and marketing, print on demand can deliver a solid passive income stream.

In case you’re not sure what it means print on demand (POD) is essentially a way of getting your designs onto physical merchandise such as T-shirts, hoodies, mugs and bags and making money by selling them online via your storefront.

Once you make a sale, the supplier then prints your design onto the item. It’s largely passive once the designs are made as in addition to the printing, the order fulfilment and shipping are also handled by the supplier!

If you’re a creative type of person who is always sketching, taking photos or writing, then you can use your creations as designs for the merchandise.

The simplest of designs are often those with just words on, like in the Classic Dad example below. Once you get the hang of it, making multiple designs along these lines will be pretty fast, allowing you to build a great inventory of products quickly.

If your designs are good and you can get traffic to your store, then you stand a great chance of earning some passive income from Print on Demand.

27. Buy or Start a Blog

If all of the above passive income ideas have whetted your appetite for making more money, but you feel that you have more time to spend building an asset, then buying or starting a blog could be for you.

Be aware that both strategies of buying or starting a blog initially come with a heavy time investment! The latter is especially so.

Buying a Blog

If we compare buying a property versus buying a website, you’d be forgiven for thinking that the former will generate a better return. But that’s not necessarily the case.

As an example, roughly speaking a website will sell for 32x its monthly income. So, let’s say you want to invest in a website that earns $1000 per month, then you’ll have to pay around $32,000 to buy it. And in 32 months’ time – a little under 3 years – it will have paid for itself (give or take hosting fees etc).

Now compare that with buying a property.

Let’s say you buy a 2-bedroom house for $150,000 and rent it out for $2000 per month. It will take 75 months (more than 6 years) to make that outlay back.

That’s assuming you are able to buy the property without a mortgage.

And on top of any potential borrowing, you’ll have to cover the costs of renting it out, repairs etc.

So, as a way to create passive income, buying a ready-made blog with existing traffic and passive income is a great idea (and one that I’m seriously considering!).

A word of caution though – if you’re going to buy a website you will need to understand how the business model works and learn what to do to fix any sudden drops in income thanks to things like a Google algorithm update.

Just buying a site and hoping it will keep earning you the same amount of money each month is likely to end in disappointment.

However, with awareness, a strategy and the regular addition of fresh content (you can hire people to write this for you), there is no reason why your initial $1000 monthly earnings can’t be increased significantly.

Starting a Blog

If you have some time at your disposal then you can build yourself an asset that will generate passive income for years to come. Be warned though – it will take a lot of time and energy up front.

Learning the basics of starting your own blog is not difficult. The hard part is staying persistent in creating content and then figuring out ways to build up traffic through SEO or social media marketing. However, once you’ve spent a few years putting in the hard work, the ongoing effort lessens while the income increases.

Once you have a blog attracting a good amount of traffic, then affiliate sales and money from ad revenue become passive income streams in their own right.

The amount of money you can generate from this type of online business is huge – and almost limitless. Some bloggers earn tens of thousands of dollars per month and have achieved true financial independence in the process.

And while it may seem like the world of blogging is a complicated minefield of website building, content writing, and SEO wizardry, I can assure you that there are a wealth of excellent resources out there that can help you take a step-by-step journey towards building true wealth for yourself and your family.

Conclusion

Hopefully, you’ve found plenty of passive income ideas in the list above to help you earn money and improve your cash flow.

If you have some genuinely spare cash that you’d like to invest and are comfortable with any associated risks, then there is no reason why you can’t tap into these strategies and create passive income for your loved ones, for retirement, or even for an abundant lifestyle!

And the really great thing about a lot of these income ideas is that they take very little time and effort to set up, meaning you can start earning passive income right away.

Hungry for more? Then head over to our Blog page for more passive income ideas, as well as other tips to help you achieve your financial goals.